Becoming MTD compliant is a major priority for HMRC and organisations who meet the VAT reporting threshold in 2019. However, there will be a number of VAT registered companies who are still confused about what compliance entails. This article, along with others here and here, help to shed light on what you need to know to be MTD ready for the future.

HMRC MTD Starting Date and Deadline

On 13 July 2018, HMRC published their VAT Notice 700/22 which, while officially coming into effect from 1 April 2019, includes a transition period where organisations using non-proprietary accounting software will not be penalised for not being fully VAT MTD compliant by this starting date.

These latest VAT reporting regulations will be fully enforceable by 2020 for all VAT registered organisations. The interim transition period gives time to allow everyone to implement any technical upgrades and system adjustments necessary and in particular provides a ‘soft landing’ for charities and SME’ s with less resources to adapt their reporting measures in good time if using traditional spread sheets from which they have manually cut and pasted.

By 2020, VAT submissions will be more in keeping with higher digital standards of record keeping, eliminating errors that manual inputting via cut and paste can cause. Obviously, increased automation of record keeping also eradicates potential tampering and enhances transparency and accountability too.

What Technical Upgrade Is Required To Be VAT MTD Compliant?

“HMRC is implementing an upgraded digital tool and new protocol, which is known technically as their MTD API. An API is a generic piece of software code, normally downloadable to a variety of software platforms or packages and which acts as a gateway that communicates with external systems, facilitating data transfer in compatible formats. It is the equivalent of HMRC’s systems asking VAT reporting bodies if their system ‘speaks MTD’.

VAT business reporting systems will therefore need to have functional software that is compatible with HMRC’s upgraded system, so that data can cross the ‘gateway’ API into HMRC’s new system. This API tool can be added onto existing software systems, like a ‘widget’, or extra piece of code, easily inputted for minimal disruption. However, compatibility with HMRC’s new system will also require MTD bridging software code that acts as a digital link to the API; it can communicate digitally with the API to ‘announce’ a company’s IT system’s ‘intention’ of imminently sending information in a format compatible with the MTD API.

There are effectively two main routes to digital compliance, namely, upgrading of current proprietary accountancy software to include the latest code that communicates with HMRC’s digital link, or the design of bespoke code for legacy IT systems that have traditionally used spreadsheets to maintain accounts.

For what future, digital data sharing looks like in practice, please see examples of possible VAT submission scenarios below.

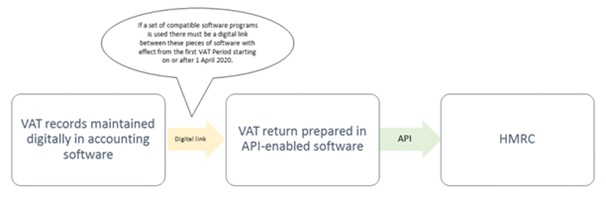

Example 1: API enabled package e.g. used by third-party accountancy service

In this example, API enablement means that existing software of your accountant has to have a string of code added to their existing off-the-shelf, or more likely, bespoke software programs, such that their system recognises the HMRC API tool and allows the transfer of client information.

An HMRC API ready system can be a simple system code add-on, taking a reporting agency or company minutes to become information sharing ready, once they upgrade their current accountancy software, or CRM with accountancy modules to the latest version.

Example 2: API enabled software and accounting software

In the example above, accounting software will be ‘off the shelf’ modular packages, custom-built systems, or combinations of the two used by a company reporting directly. A digital link can be easily designed by the software provider to upgrade and provide connectivity and interoperability between pre-existing accounting software and HMRC’s new API. This added code allows the key ‘API’ to speak to the accountancy software package, confirm compatibility of systems and allow transfer of VAT data to HMRC.

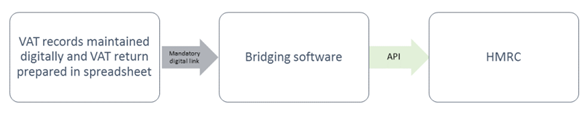

Example 3: Digitally maintained records in a spreadsheet with bridging software

In Example 3 above, business accounts spreadsheets are updated by finance staff as usual, but these data sources also facilitate VAT Return prepared data via the implementation of new bridging software that formats data appropriately for transfer. A digital link can be easily outsourced to software programmers and acts as so-called ‘bridging software’. This new data management combination will become mandatory for operators of spreadsheet-based accounting systems.

This integrated bridging software will be able to feed data through the API automatically, such that this software solution acts as an efficient, compatible gateway to HMRC.

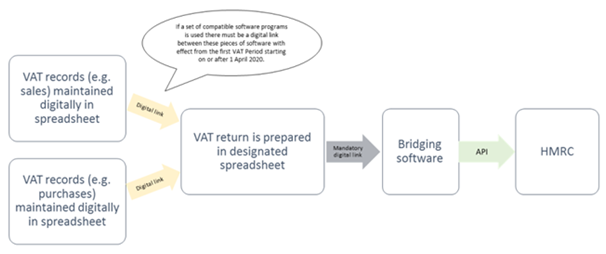

Example 4: Multiple spreadsheets used with bridging software

In example 4 above, a company has complex data management systems. However, the process still reflects the above two operational systems. Here, however, various data sources need to be combined for VAT reporting purposes e.g. multiple sites or business vertical data, which may or may not be in similar formats and may or may not be digitally inter-linked. Such fragmented data is collated into a reporting-ready spreadsheet or format. Any organisation operating complex and multiple data feed will need to invest in bridging software that recognises the HMRC API and allows through-feed to HMRC.

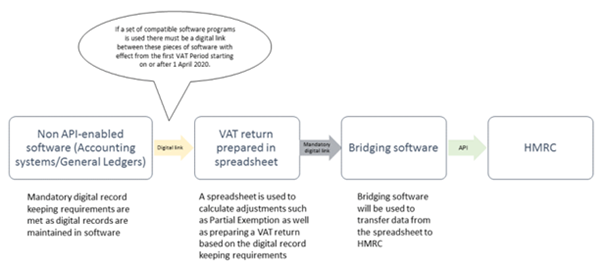

Example 5: Using Accounting Software, Spreadsheet and Bridging Software

Example 5 is where businesses and organisations are operating legacy accounting systems, or outsource accountancy services to companies who have their own IT systems. Links can be added to data storage files by a programmer, such that they can be accessed via a digital link from a designated spreadsheet, specifically designed for VAT Returns, or MTD compliance becomes the concern of one’s reporting agent. Addition of ‘bridging software’ will easily allow transfer of the VAT MTD to HMRC.

The types of records subject to the new rules will be specified later in this article, but it is vital to know that data must be entirely digital in terms of storage and transmission by 2020 for all VAT registered organisations and by 2019 if using proprietary accountancy software packages.

During the transition period, it will be acceptable to take data from some incompatible software and then pass it through a compatible spreadsheet, as illustrated above. Where VAT details are highly complicated, some organisations may still have to work this way.

However, HMRC has stipulated that data is not to be (manually) ‘rekeyed’. Rather, data transfer must happen electronically, submitted to your own or agent’s VAT reporting spreadsheet, or from the spreadsheet back into the compatible software platform, then submitted to HMRC.

While initial digital taxation reporting proposals negated the use of spreadsheets, complex taxation issues faced by some, together with intense lobbying from accountants, professional bodies and various select committees, HMRC compromised, leading to the requirement for functionally compatible ‘bridging software’ This bridging software upgrade connects automatically with the MTD API.

Which VAT Return Data Must Be MTD Compliant

The new rules apply if your taxable turnover is above the VAT registration threshold. There are some exemptions available and businesses or organisations who are unclear about the detail of how the regulations apply to them should seek professional advice from an MTD Consultant.

All VAT registered businesses must keep and maintain specific records and accounts, but under this latest Making Tax Digital system, particular categories of records must be kept digitally within functionally compatible software to HMRC’s MTD API, i.e. their digital tool and set of technical protocols that allow transfer of data between external IT systems and digital platforms.

Records that are not specified in the VAT 700/22 MTD notice, or are not a legal requirement for your VAT Return, will not have to be kept in compatible software. For instance, simple Xcel spreadsheets without digital links to source data are still permissible for all but the following data types:

1. Designatory Data

Your organisation or business must have a digital record of your:

- business name

- principal place of business address

- VAT registration number

- VAT accounting scheme

2. Supplies Made

For each product or service supplied to customers and/or clients you must record:

- time of supply (i.e. the ‘tax point’)

- value of any supplied product or service (i.e. net value, excluding VAT)

- rate of VAT charged

This only includes supplies recorded as part of your VAT Return. Supplies that do not get submitted on your VAT Return do not need to be recorded in functional compatible software. One example could be intra-group supplies for a VAT group, which are not covered by the Making Tax Digital rules.

3. Supplies Received

For each supply you receive you must record the:

- time of supply (‘tax point’)

- value of that supply

- amount of input tax that you will claim

This stipulation only includes supplies recorded as part of your VAT Return. Thus, supplies not relevant to your VAT Return do not need to be recorded in functionally compatible software. For example, wages paid to an employee would not be covered by these rules.

4. Reverse Charge Transactions

A Reverse Charge shifts responsibility for reporting of any VAT transaction from the seller to the buyer of goods or services. When any transaction becomes subject to Reverse Charge, the recipient of goods or services reports both their purchase (input VAT) and the supplier’s sale (output VAT) in their VAT return. Given the scope for human error here, any digital link in data can simplify administration, minimise confusion and ensure greater accuracy in HMRC VAT submissions.

5. Summary Data

To support your VAT Return, your upgraded, HMRC compatible software must contain the following data inputs:

- the total output tax you owe on sales

- the total tax you owe on acquisitions from other EU member states

- the total tax you are required to pay on behalf of your supplier under a reverse charge procedure

- the total input tax you are entitled to claim on business purchases

- the total input tax allowable on acquisitions from other EU member states

- the total tax that needs to be paid, or you are entitled to reclaim, following a correction or error adjustment and any other adjustment allowed or required by VAT rules

- a total of each type of adjustment must be recorded as a separate line.

Without technical expertise in software system management, we appreciate that the various possible options for organisations wishing to be MTD compliant at the earliest opportunity can seem consuming and the prospect of compliance in time can feel overwhelming. Meer & Co can offer MTD help, however, with a consultant who can assess your current situation with a view to helping you transition smoothly to the new VAT preparation obligations in good time. Please get in touch today if you have any questions about the issues addressed in this article.

We invite you to learn why companies are turning to Meer & Co. as their preferred provider of assurance and consulting services. For more information, please contact us at [email protected] or call us on +44 (0)207 987 3030.